Crowdfunding is sometimes touted as a “safety net” for people who can’t afford to pay their medical bills.

But new research from the University of Washington, believed to be one of the first large-scale assessments of medical crowdfunding in the U.S., shows that people in states with higher medical debt and lower rates of insurance coverage are more likely to try to raise money but less likely to succeed.

This so-called safety net, researchers point out, isn’t much of one at all.

“We tend to think of crowdfunding as something that can help out anyone in hard times, but this data really indicates that where people need the most help paying for health care, crowdfunding provides the least help,” said Nora Kenworthy, associate professor of nursing and health studies at UW Bothell.

The study, published Feb. 3 in the American Journal of Public Health, collected data from more than 437,000 GoFundMe campaigns over a five-year period and analyzed, at the county and state level, crowdfunding use and outcomes. With the help of Census data and other information, Kenworthy and UW co-author Mark Igra, a graduate student in sociology, assessed how many campaigns were started, and how much money was raised, in areas with more or less income, medical debt and health insurance coverage.

The UW researchers have explored various angles of crowdfunding—who uses it, where they live and how successful their campaigns are. Last year, Igra and Kenworthy focused on crowdfunding during the first several months of the COVID-19 pandemic and found that campaigns were more successful in wealthier and more educated communities, a trend they attributed not just to financial resources available in such communities, but also to potentially wider—and wealthier—social networks. Igra and Kenworthy also found that 90% of campaigns, regardless of location, failed to meet their goals.

For this study, the researchers wanted to examine medical crowdfunding, and the extent to which it helps people who struggle to pay for health care in the U.S.

On GoFundMe, which holds the majority of the crowdfunding market in the U.S., more than one-third of campaigns are related to health care. GoFundMe reports more than 250,000 campaigns to finance medical needs are started each year, raising more than $650 million.

The UW study amassed one of the largest, publicly available datasets of GoFundMe campaigns in recent years, from 2016 through 2020, and demonstrated that more campaigns were started in low-income and under-insured communities, but campaigns in more affluent communities with higher rates of insurance coverage raise substantially more money. Among other findings:

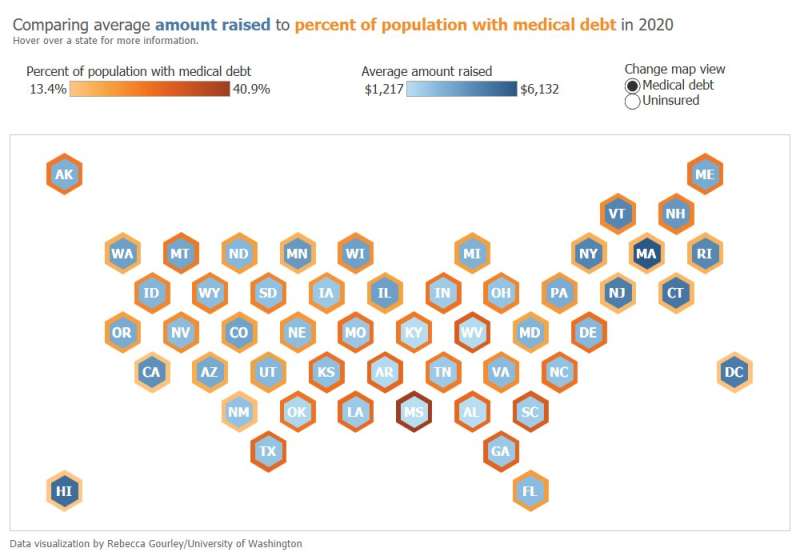

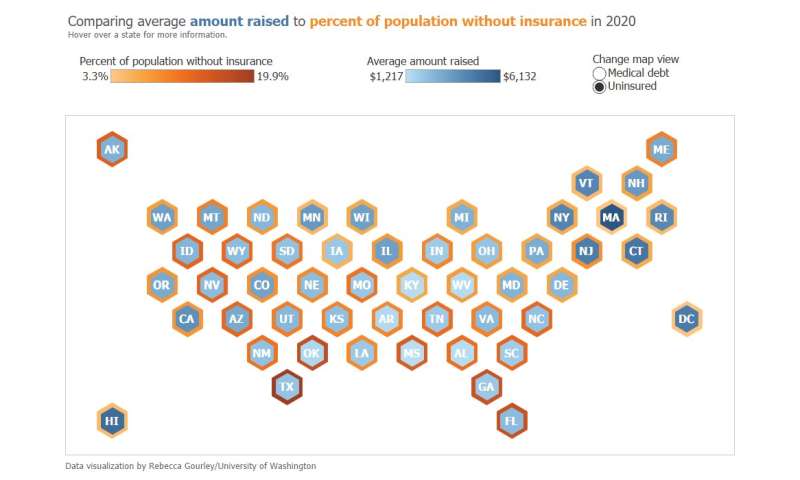

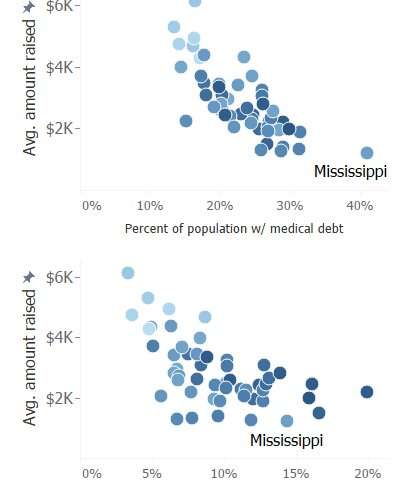

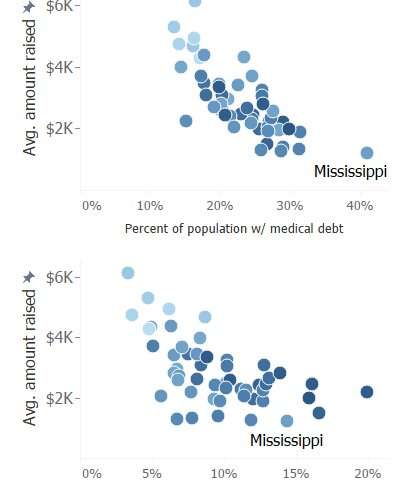

These scatterplots show that states with higher percentages of the population with medical debt, and higher percentages of uninsured people raise less money from crowdfunding. Credit: Rebecca Gourley/University of Washington

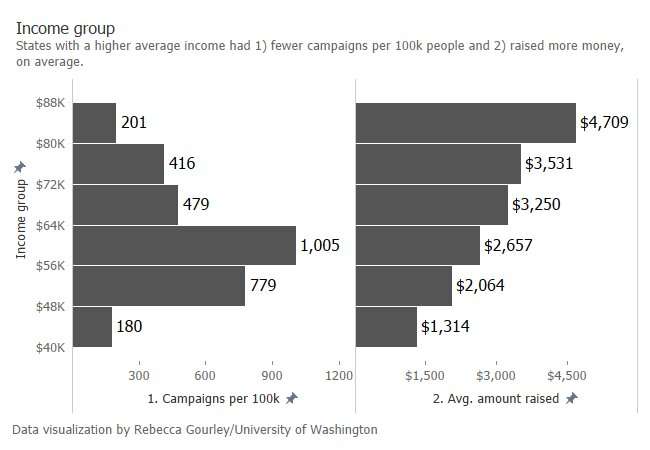

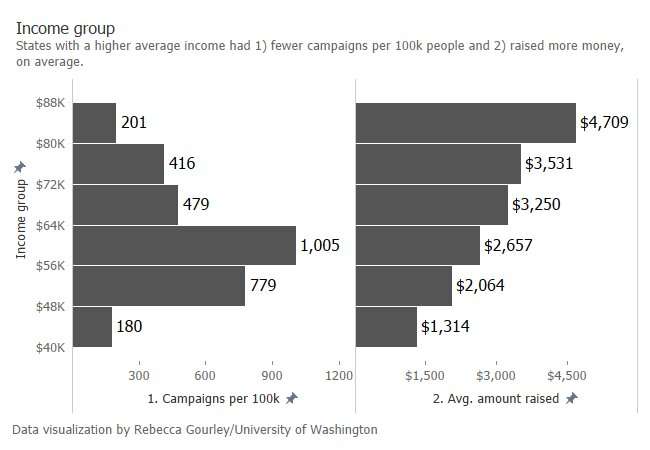

These scatterplots show that states with higher percentages of the population with medical debt, and higher percentages of uninsured people raise less money from crowdfunding. Credit: Rebecca Gourley/University of Washington These bar charts show the number of campaigns and amount raised by income level. Credit: Rebecca Gourley/University of Washington

These bar charts show the number of campaigns and amount raised by income level. Credit: Rebecca Gourley/University of Washington These scatterplots show that states with higher percentages of the population with medical debt, and higher percentages of uninsured people raise less money from crowdfunding. Credit: Rebecca Gourley/University of Washington

These scatterplots show that states with higher percentages of the population with medical debt, and higher percentages of uninsured people raise less money from crowdfunding. Credit: Rebecca Gourley/University of Washington These bar charts show the number of campaigns and amount raised by income level. Credit: Rebecca Gourley/University of Washington

These bar charts show the number of campaigns and amount raised by income level. Credit: Rebecca Gourley/University of Washington

- Over that five-year period, the 437,596 campaigns in GoFundMe’s “medical, illness and healing” category raised more than $2 billion, with the median campaign earning just under $2,000

- During that period, 16% of campaigns raised nothing, while less than 12% met their goal

- Median numbers of donations and returns declined over time, hitting their lowest in 2020

- In 2020, just under 18% of campaigns were started in areas with the highest household income bracket (between $73,000 and $130,000), but accounted for more than one-fourth of total money raised

- That same year, 20% of campaigns were launched in the lowest income bracket ($19,000 to $47,000), accounting for 12% of total earnings. This is less than half of the earnings of the high-income bracket.

- Similarly, there were more campaigns in states with higher percentages of people with medical debt and without insurance. Those campaigns raised less money than campaigns in other states. Mississippi, for example, has the highest percentage of the population with medical debt and is among the highest in percentage of uninsured, but crowdfunding campaigns there raised the least money of all 50 states.

In examining 2020 data—the last full year available—researchers said one statistic stood out: 33.8% of campaigns were unfunded. The percentage varied so much from that of previous years, when the portion ranged from zero to 4%, that researchers believe the pandemic alone wasn’t the cause. Rather, it appears more successful campaigns remain on the website longer, and thus previous years’ data may over-represent successful campaigns. In addition, unfunded campaigns appear to be removed from the site, either by the campaign creators or the website moderators, after one year, the researchers said.

“Because the campaigns people see on social networks are almost always the small subset that are shared widely, the public may have the impression that crowdfunding is more likely to be successful than it really is,” Igra said.

Greater transparency from all crowdfunding companies would allow more research and policymaking that could help address the very needs that crowdfunding purports to address, the researchers say. While thousands of people turn to crowdfunding to pay their medical bills, the study’s findings point to a more equitable and comprehensive solution: better health insurance coverage and social assistance programs.

“Relying on marketplace-based solutions only deepens already steep health inequalities. This research underscores the need for broader safety net programs that provide help to all those who need it,” Kenworthy said.

University of Washington